Monday, September 9, 2024

Dear Friends,

Dear Friends,

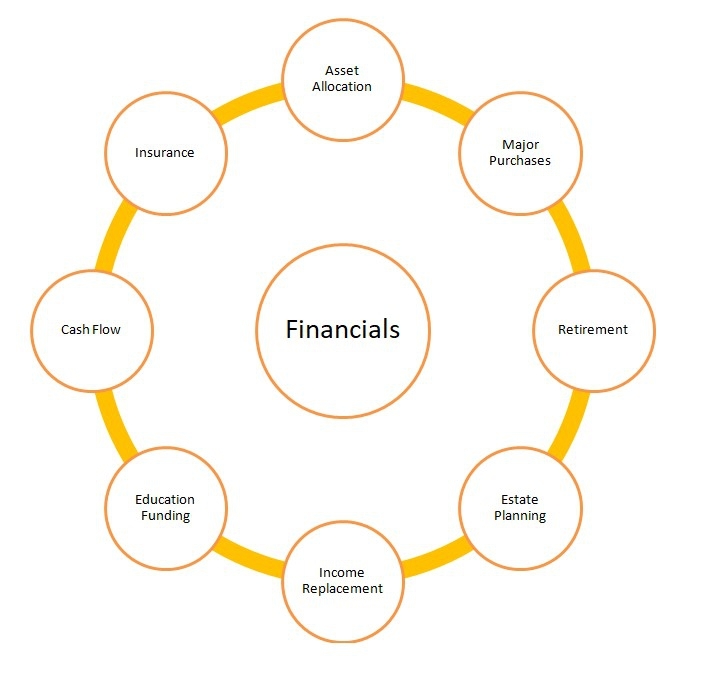

Summer is over. The Fall Season is upon us! Now is a good time for a Financial Review.

There are questions we all need to be asking ourselves about the following:

Life Insurance – which we put on ourselves to protect our loved ones when we pass whether they are family, business partners or our favorite charities. Ask yourself: Do I have life insurance? How long have I had life insurance? Is it sufficient for my needs today? Do I need more? Do I need less?

Critical Illness Insurance – which we put on ourselves for ourselves. To give us some of the time we need to heal up from an event like a heart attack, cancer diagnosis or stroke (to name a few illnesses) by providing a lump sum to cover bills and expenses. Ask yourself: Do I have critical illness insurance? How long have I had critical illness insurance? Is it sufficient for my needs?

Disability Coverage – which we put on ourselves for ourselves and our families. To give us breathing room to heal up and reduce our stress over our bills and expenses. Ask yourself: Do I have disability insurance? What type of coverage is it? How long have I had it? Is it sufficient for my needs today?

Debts - having a plan to become debt free is important because debt freedom is important. Why? Because it puts money back into your pocket. Ask yourself: Do I have a reduction plan in place? Do I know how much my debts are costing me? Do I know when I will be debt free?

Retirement – at some point we will all want to retire or we will be forced to retire. Ask yourself: Do I have a retirement plan? When's the last time I had it reviewed? When can I retire? What could possible side line my retirement plans?

Education Plans – for our children and grandchildren there are Registered Education Savings Plans (RESPs). To provide for them the opportunity to seek higher education while reducing some of the associated costs. Ask yourself: Do I have an education plan? Do I have an RESP? Am I in a position to take advantage of some of the government benefits of an RESP?

Friends & Family – who do you know, who could benefit from this information?

Want to know more? Contact me today.

Posted at 07:16 AM